Finance

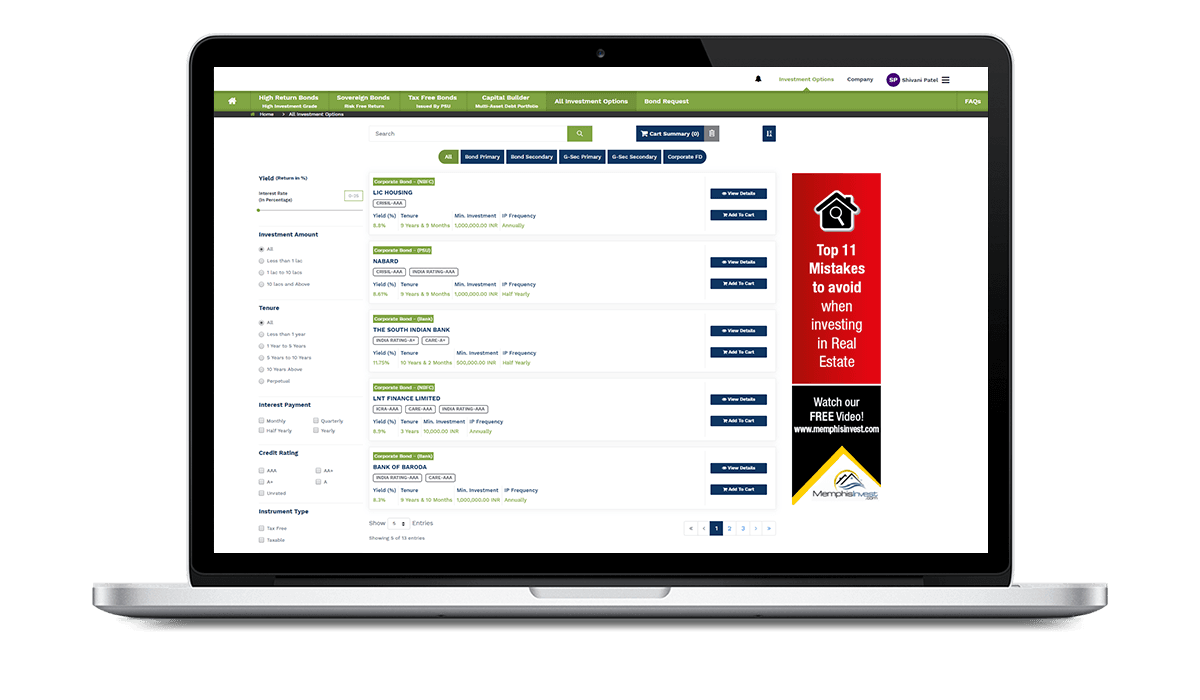

Fixed Income Securities Investment Portal

Case study

About the Project

Portal is an online marketplace for fixed income instruments, such as Bonds and Debentures, exclusively. Portal aim is to make these superior investment options easily accessible and investable by the retail investors via our online platform. Portal is SaaS based solutions which is developed for B2C and B2B both kind of users.

B2C Portal provides a following feature for the users.

1. Ability to publish offers on Corporate and Government sector bonds and FDs.

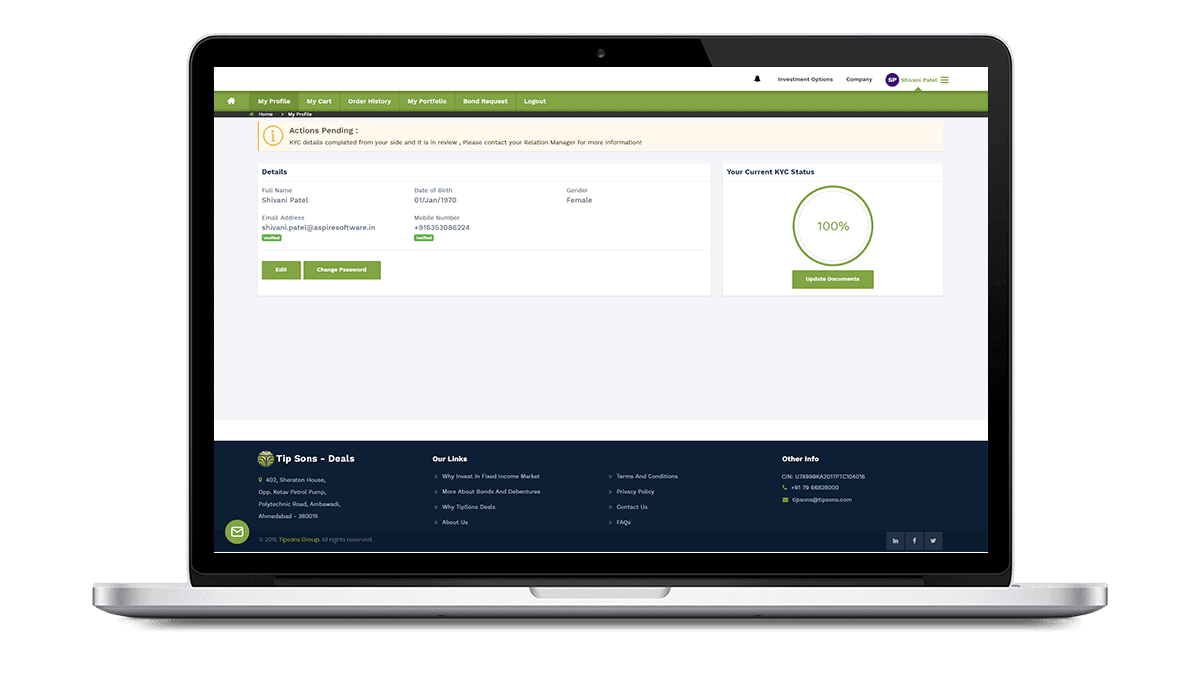

2. End-user KYC document and automated validations of PAN number. Export of KYC documents to submit it to NSCCL.

3. Product (Bond/FD) issuer and issue details.

4. Forecast table for Interest payment on each product. So, user can play with investment amount to know how much (S)he will get interest on investment.

5. Email, SMS, Mobile notifications for investors to make sure they do not miss any exciting investment offers.

6. Chat module between investors and agents to support investors.

7. User Investment Portfolio management

8. Easy options available to manage site content in admin control panel. (Like., Terms of use, Privacy policy, home page marketing content, FAQ etc.)

9. Mobile application support via REST API.

B2B Portal provides a following feature for the users.

1. Easy to generate multiple sites.

2. White labelling option for branding and organization specific contents.

3. Auto commission calculations.

4. Online service subscriptions

5. Customer management

6. Various Reports like., Performance Summary, Profit and Loss, etc.

Customer

Our customer has emerged as one of the leading players in the financial services sector in india, founded in 1993. They provide the entire value chain of all financial services under one roof. The company is headquartered in ahmedabad, has offices in 7 major cities across india, and is registered with Sebi as a category-i merchant banker. Our customer has been impanelled to various public sector banks, private banks, pf & pension trusts for investment.

ASPIRE SOFTSERV

Benefits Delivered

End-users are able to get the details of each available product on marketplace

Portal helps investors to take decision regarding investments

30% business growth within two months of launch, compared to manual process

Companies employee can focus on business growth, as partial queries of investors are resolved by portal

Ease to market the investment products

Global platform for investor and easy to reach investors.

Problem Statement

Our customer wanted to develop a portal that can be a marketplace for fixed-income securities investors. The customer told us that our customer has no such facilities that they can go online and check regarding all available investment options in one shot. Also, they don’t have such a facility from where they can get our tips for the investment. Due to this problem, investors often missed the right opportunity for an investment.

Product should reflect a purpose precisely

Easy to manage contents from portal

It should follow rules and regulations of SEBI for deals

Compete for market products

Make it revenue generated as quickly as possible

Online payment support

Deal details and forecasting about benefits

Realtime notification to interested investors

Portfolio management

It is currently implemented as a B2C platform only

Cash Flow calculation was the toughest part, in which customer supported us a lot.

Specialized bank gateway integration was a challenge, which can allow really big amount of transactions.

Application must not have any vulnerabilities and should be highly secured as it is providing financial services

Solutions

Aspire’s Solution

Aspire established an end to end product development offshore team, starting from the concept building to finished product delivery to support.

Liferay based CMS site developed for marketing and public pages. So, customer can change application content by themselves.

01

Successfully integrated bank gateway for big transactions.

02

AWS cloud based secure application environment setup

03

Vulnerabilities testing via sonarQube and Tanable.io.

04

Performed penetration testing to make sure application is secure.

05

Created product gallery which suites domain concept and for users to get product details easily

06

Complex cash flow forecasting calculations for bonds

07

End user’s checkout and portfolio management

08

Automated PAN verification

09

Realtime email, SMS and push notification only for the interested users.

10

Mobile application for ease of use

11

Intuitive and responsive web application user interface

12

Admin panel to manage end users, products and other details.

13

Various types of Excel and PDF based reports

14

LATEST BLOG

Read the Most Recent Blogs

REACH OUT

Ready to Build Something Great ?

80+

Tech Experts

14+

Years Of Developing

90%

Referral Business